Understanding Roth IRA Withdrawals for Home Purchases

Eligibility for Withdrawal

- First-Time Homebuyer Status: To qualify as a first-time homebuyer under IRS rules, you must not have owned a primary residence in the last two years. This applies to both you and your spouse if applicable.

- Account Age Requirement: Your Roth IRA must be open for at least five years from January 1 of the year you made your first contribution to withdraw earnings without penalties.

- Withdrawal Limits: You can withdraw your contributions at any time without penalty. Additionally, you can withdraw up to $10,000 of earnings tax-free and penalty-free if used for purchasing a first home, provided the account meets the age requirement.

Withdrawal Process

- Direct Withdrawals: You can directly withdraw funds from your Roth IRA to cover the purchase costs of the home. This includes down payments and closing costs.

- Timing: The withdrawn funds must be used to purchase the home within 120 days of receipt.

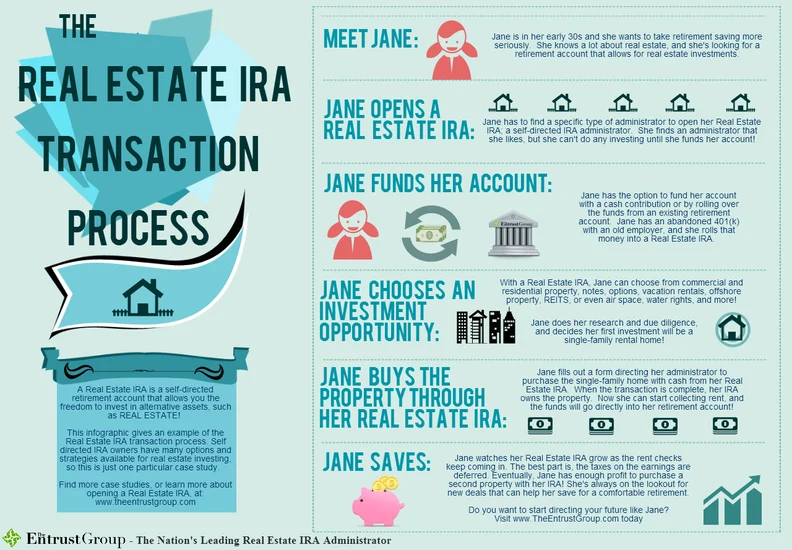

Using a Self-Directed Roth IRA for Real Estate Investment

Self-Directed Roth IRA

- Account Setup: To invest in real estate through a Roth IRA, you need to open a self-directed Roth IRA with a trustee that specializes in real estate investments.

- Investment Restrictions: The property must be titled in the name of the IRA, not in your personal name. You cannot personally manage or live in the property; it must strictly be an investment asset.

- Prohibited Transactions: Engaging in personal use of the property or transactions with disqualified persons (like family members) is prohibited and can lead to severe tax penalties and loss of tax advantages associated with the IRA.

Financial Management

- All income generated from the property (e.g., rental income) must go back into the IRA, and all expenses related to the property must be paid from it. If additional funds are needed for investment, you may partner with others, sharing undivided interests in the property.

Considerations and Risks

- Retirement Savings Impact: Withdrawing funds from your Roth IRA reduces your retirement savings and potential future growth due to compound interest. Financial advisors often recommend considering this option as a last resort.

- Tax Consequences: If you do not meet the eligibility criteria for penalty-free withdrawals, you may face income taxes and penalties on early withdrawals, particularly if you are under 59½ years old.

Prohibited Personal Use

- Strict Investment Purpose: Properties bought with funds from a Roth IRA must be used solely for investment purposes. This means you and any disqualified persons cannot live in, vacation at, or otherwise use the property for personal enjoyment or benefit.

- Definition of Disqualified Persons: The IRS defines disqualified persons as individuals who cannot benefit from the property. This includes:

- You (the account holder)

- Your spouse

- Your parents, grandparents, and their spouses

- Your children and their spouses

- Any fiduciaries of the IRA

- Self-Dealing Prohibition: Engaging in transactions that benefit you or disqualified persons is considered self-dealing. For example, if you purchase a rental property and allow family members to live there—even if they pay rent—this would violate IRS rules and could lead to severe tax penalties, including disqualification of the entire IRA.

Financial Management Responsibilities

- Expense Payments: All expenses related to the property—such as repairs, utilities, taxes, and insurance—must be paid directly from the Roth IRA. You cannot use personal funds for these expenses. This requires maintaining sufficient cash in your IRA to cover ongoing costs.

- Income Handling: Any income generated from the property must also go back into the Roth IRA. This includes rental income, which should not be deposited into your personal accounts.

Consequences of Violating Rules

- Tax Implications: If you inadvertently live in or use the property for personal purposes, it may trigger a prohibited transaction ruling by the IRS. This could result in your entire Roth IRA being treated as distributed, leading to immediate taxation on its value and potential penalties if you're under 59½ years old.

- Legal Risks: Violating these rules can also expose you to legal consequences and jeopardize your retirement savings by disqualifying your IRA's tax-advantaged status.

Using a Roth IRA for Your First Home Purchase: Everything First-Time Buyers Need to Know

If you're a first-time homebuyer, you may be exploring every possible avenue to fund your new home. One option that often comes up is using retirement savings—specifically, your Roth IRA. But can you withdraw from a Roth IRA to buy a house? And if so, what are the rules and potential pitfalls? In this comprehensive guide, we'll break down everything you need to know about withdrawing from your Roth IRA for a home purchase.

Can You Withdraw from a Roth IRA for a Home Purchase?

Yes, you can withdraw from a Roth IRA for a home purchase, but there are specific rules you must follow to avoid penalties and taxes. The IRS allows first-time homebuyers to withdraw up to $10,000 of earnings from their Roth IRA without facing the usual 10% early withdrawal penalty. However, the account must have been open for at least five years to qualify for this exemption.

Roth IRA First-Time Home Buyer Rules

Here are the key Roth IRA first-time home buyer rules you should be aware of:

-

Five-Year Rule: Your Roth IRA must have been open for at least five years before you can withdraw earnings penalty-free for a home purchase.

-

$10,000 Lifetime Limit: You can withdraw up to $10,000 of earnings for a first-time home purchase without paying the 10% penalty. This is a lifetime limit, not an annual one.

-

Definition of First-Time Homebuyer: According to the IRS, you're considered a first-time homebuyer if you haven't owned a home in the past two years.

-

Use of Funds: The withdrawn funds must be used to buy, build, or rebuild a first home and must be used within 120 days of the withdrawal.

How to Withdraw from Roth IRA for Home Purchase

If you meet the above criteria, here's how to withdraw from your Roth IRA for a home purchase:

-

Contact Your IRA Provider: Inform them that you intend to make a qualified first-time homebuyer withdrawal.

-

Document the Purchase: Keep all relevant documentation, such as the purchase agreement and proof of closing, to demonstrate that the funds were used appropriately.

-

Withdraw Contributions First: Since Roth IRA contributions can be withdrawn at any time tax- and penalty-free, you may want to withdraw contributions before touching earnings.

What About Traditional IRA Withdrawals?

If you're wondering, "Can you withdraw from an IRA to buy a house?" the answer is also yes, but with slightly different rules. For traditional IRAs, the $10,000 withdrawal is also penalty-free for first-time homebuyers, but you will still owe income taxes on the withdrawn amount.

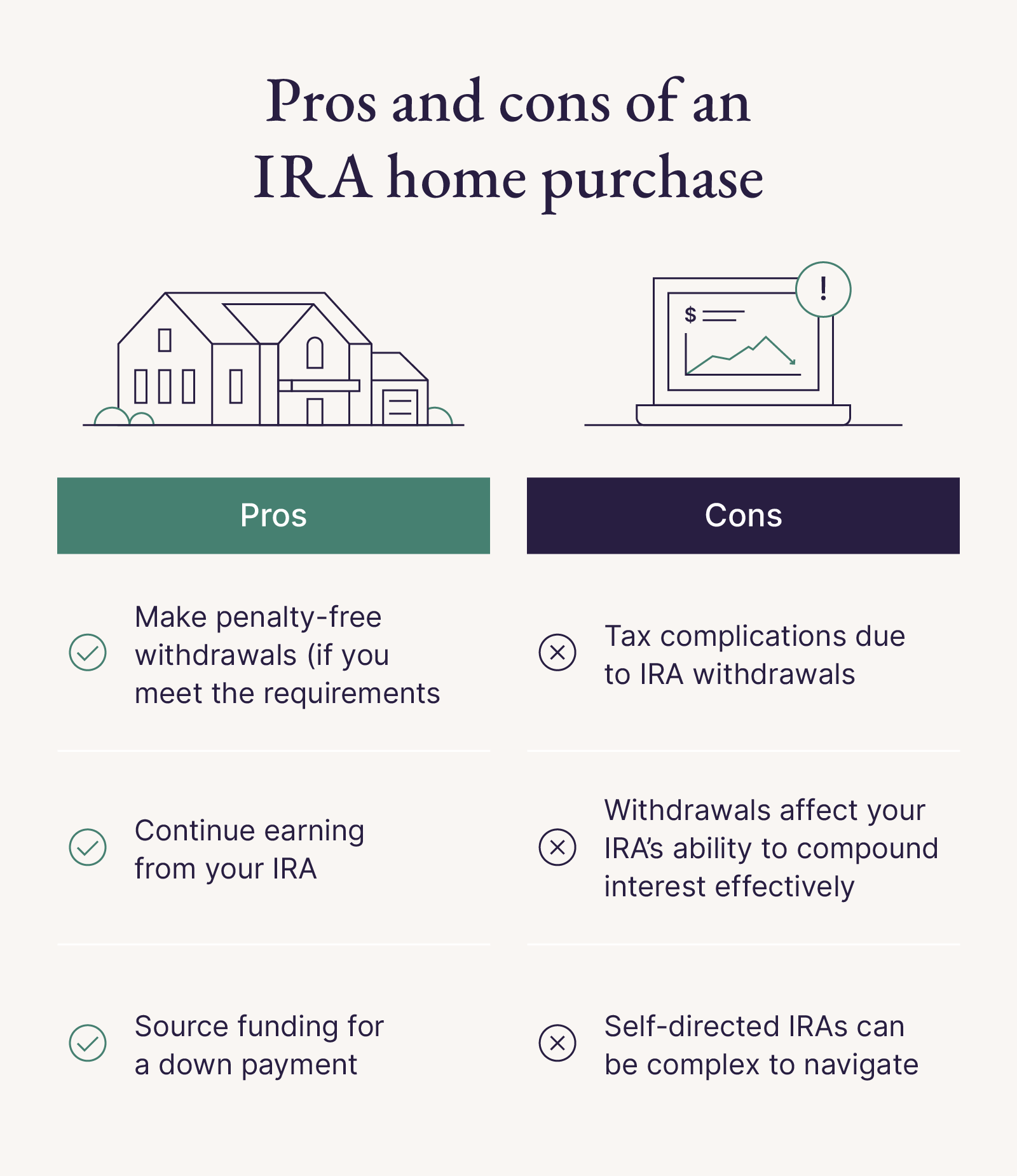

Pros and Cons of Using a Roth IRA to Buy a House

Pros:

-

Access to funds without penalties if rules are followed.

-

Flexibility to withdraw contributions anytime tax-free.

-

Helps bridge the gap for a down payment.

Cons:

-

Reduces retirement savings.

-

Potential tax implications if rules aren’t met.

-

Limited to $10,000 for earnings, which might not be enough for some markets.

Is Withdrawing from a Roth IRA the Right Move for You?

While using your Roth IRA for a home purchase can be a helpful resource, it’s essential to weigh the long-term impact on your retirement savings. Consider speaking with a financial advisor to explore all your options and ensure you’re making the best decision for your financial future.

TL;DR

For more personalized guidance on investing in real estate, visit Casa Real Luxury Real Estate by Michael Santiago.

Categories

Recent Posts