Why Now is the Perfect Time to List Your Property for Maximum Profit

Economic Conditions Favoring Sellers

High Home Prices

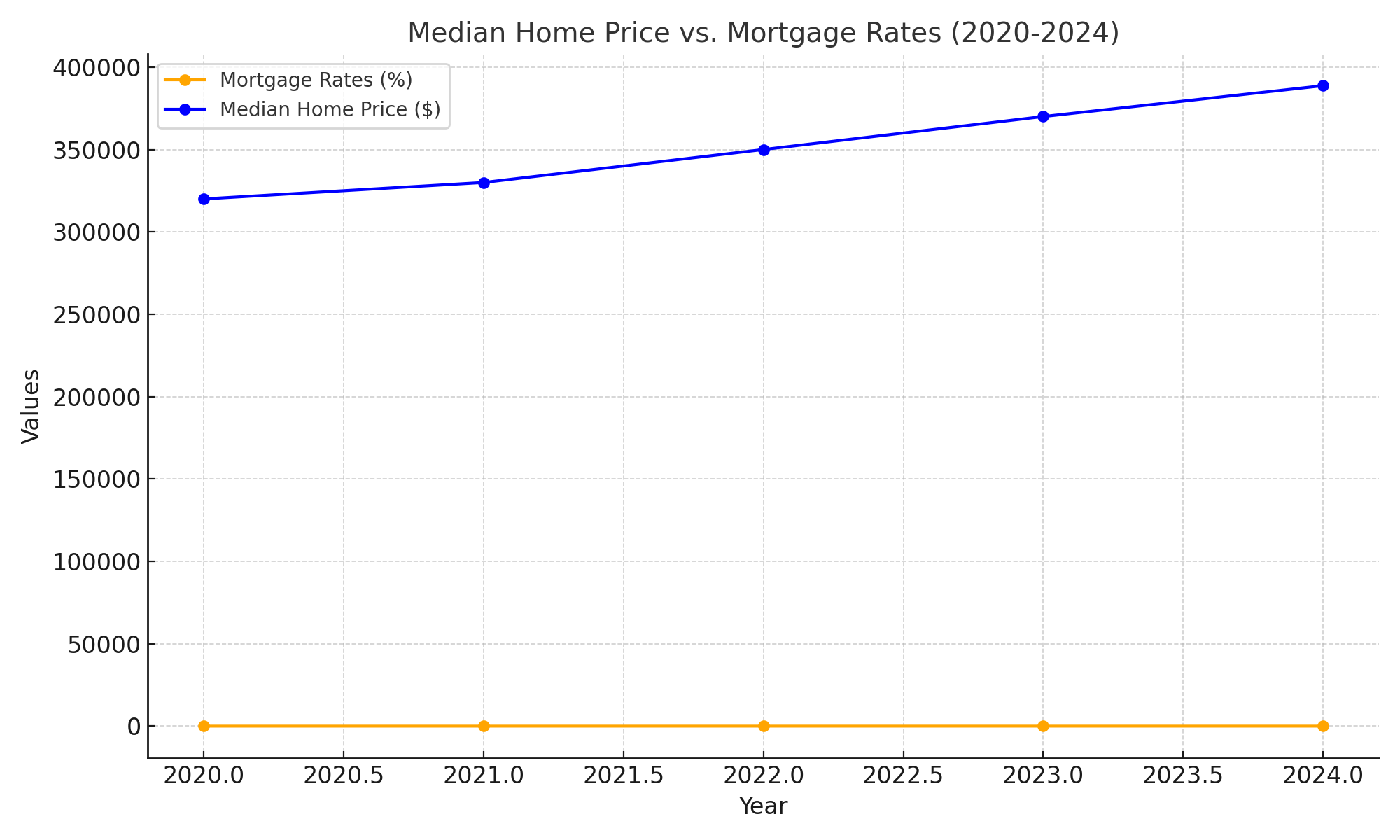

As of recent reports, the median U.S. home price sits at $434,568, representing a 5.1% increase year-over-year. This upward trend suggests that many areas are experiencing heightened demand, which can translate to significant profit for sellers who enter the market now.Inflation Effects

Inflation continues to strain purchasing power, impacting buyer behavior. Many buyers who have been on the sidelines may feel compelled to purchase sooner rather than later to avoid future price hikes. This urgency can create an advantageous selling environment for homeowners ready to list.Why Listing Now Could Maximize Your Profit

Leverage Buyer Urgency

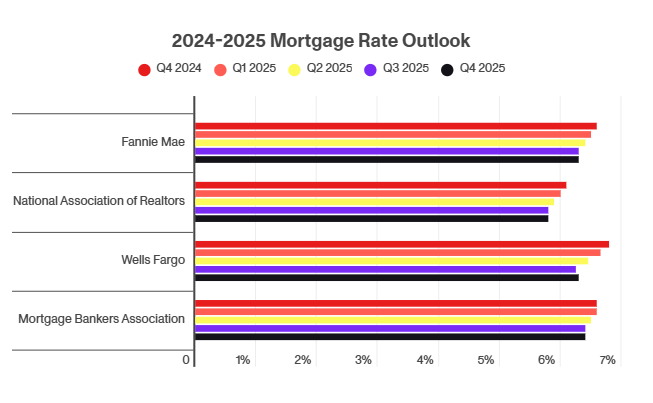

With economic predictions leaning toward sustained high mortgage rates and lingering inflation, buyers are more likely to act quickly. Listing your home now allows you to capitalize on this urgency, potentially leading to multiple offers and a bidding war, which could significantly boost your sale price.Historically, the spring market tends to yield higher sales prices due to increased buyer activity. However, given the current landscape, listing before the traditional buying season can position your property ahead of an influx of inventory, allowing you to stand out in a less crowded field.

The Future Outlook

While the housing market remains unpredictable, the prevailing conditions suggest it won't improve significantly in the near term. High mortgage rates and low inventory levels are anticipated to persist, meaning potential buyers might find themselves sidelined longer, waiting for a market shift that may not come soon. Listing now provides sellers with a unique window to maximize profits before any further economic changes occur.

Navigating Post-Sale Concerns for Home Sellers

Selling a home is a significant milestone, and it often raises concerns about what comes next. Understanding the current market trends and leveraging your position as a seller can help ease anxieties. Here's a comprehensive guide addressing common concerns sellers face and offering strategies for a smooth transition.

1. No Need to Fear Interest Rates: Pay Cash and Refinance Later

In today’s high-interest-rate environment, sellers who cash out their home equity can avoid immediate rate concerns by purchasing their next home with the cash proceeds from selling their home. Paying cash eliminates the need for mortgage approval delays and allows for quicker closings. If rates drop later, cash buyers can refinance to take advantage of better terms, saving money in the long term. This flexibility is a major benefit, especially in a competitive market where cash is king.

If you're looking to buy a home but want to explore creative financing options, a Home Equity Line of Credit (HELOC) could be a smart solution. A HELOC allows you to leverage the equity in your current home to secure funds for a down payment or even purchase an investment property—often with more flexibility than traditional loans. Before making a decision, it's important to understand the facts. Check out our blog post on 3 Timely HELOC Myths Homeowners Should Know Now to separate myth from reality and see if this strategy is right for you

2. Benefit from High Prices and Continued Equity Growth

Although home prices are currently high, they continue to rise in most markets, driven by limited inventory and strong demand. This means sellers can capitalize on the appreciation of their property’s value. For instance, home prices in many U.S. markets have seen steady increases over the past few years, providing a golden opportunity for sellers to reinvest and grow their wealth.

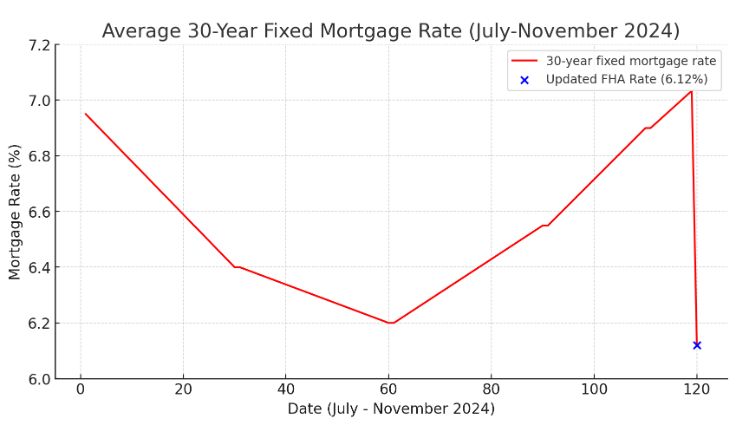

Data Insight: Freddie Mac's latest market analysis shows that mortgage rates peaked at 7% in November 2024, contributing to a slowdown in price appreciation. Sellers in high-demand areas, however, continue to benefit from stronger-than-average price growth, while those in secondary markets are feeling the pinch.

3. Move to Neighborhoods with Stronger Equity Gains

Selling in a high-equity market gives you the financial leverage to purchase in neighborhoods experiencing even greater appreciation potential. Many sellers use this opportunity to upgrade their lifestyle or invest in areas with stronger job growth and infrastructure, which often correlate with higher long-term equity growth.

4. Managing Proceeds from the Sale

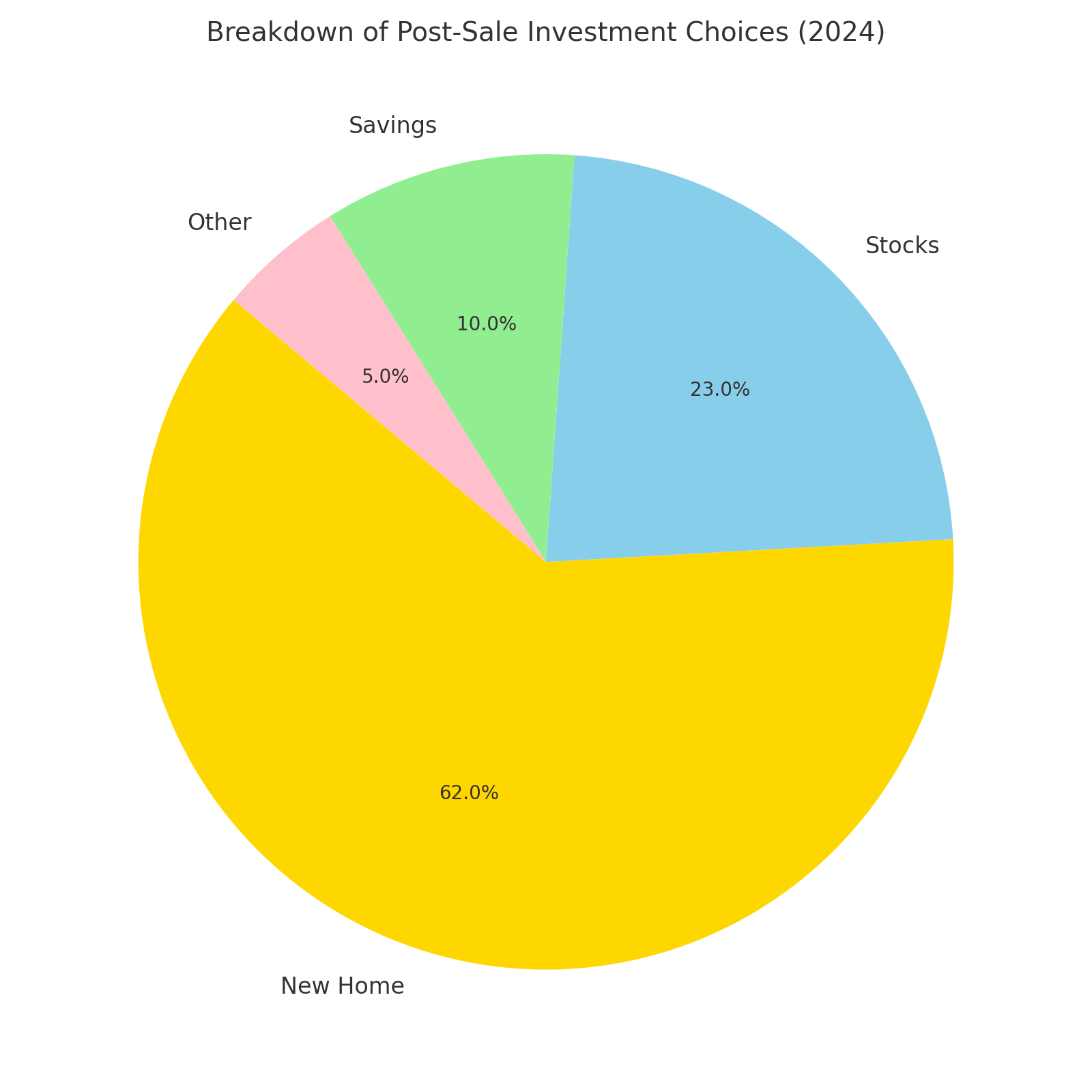

For many sellers, their home is their most significant financial asset. Knowing how to reinvest or save the proceeds can be overwhelming, especially during periods of economic uncertainty.

Financial Insight: A recent Bankrate survey highlighted that 62% of sellers in 2024 reinvest their gains into another property, while 23% choose diversified investments, reflecting a growing desire for liquidity amidst market fluctuations.

5. Tax Implications

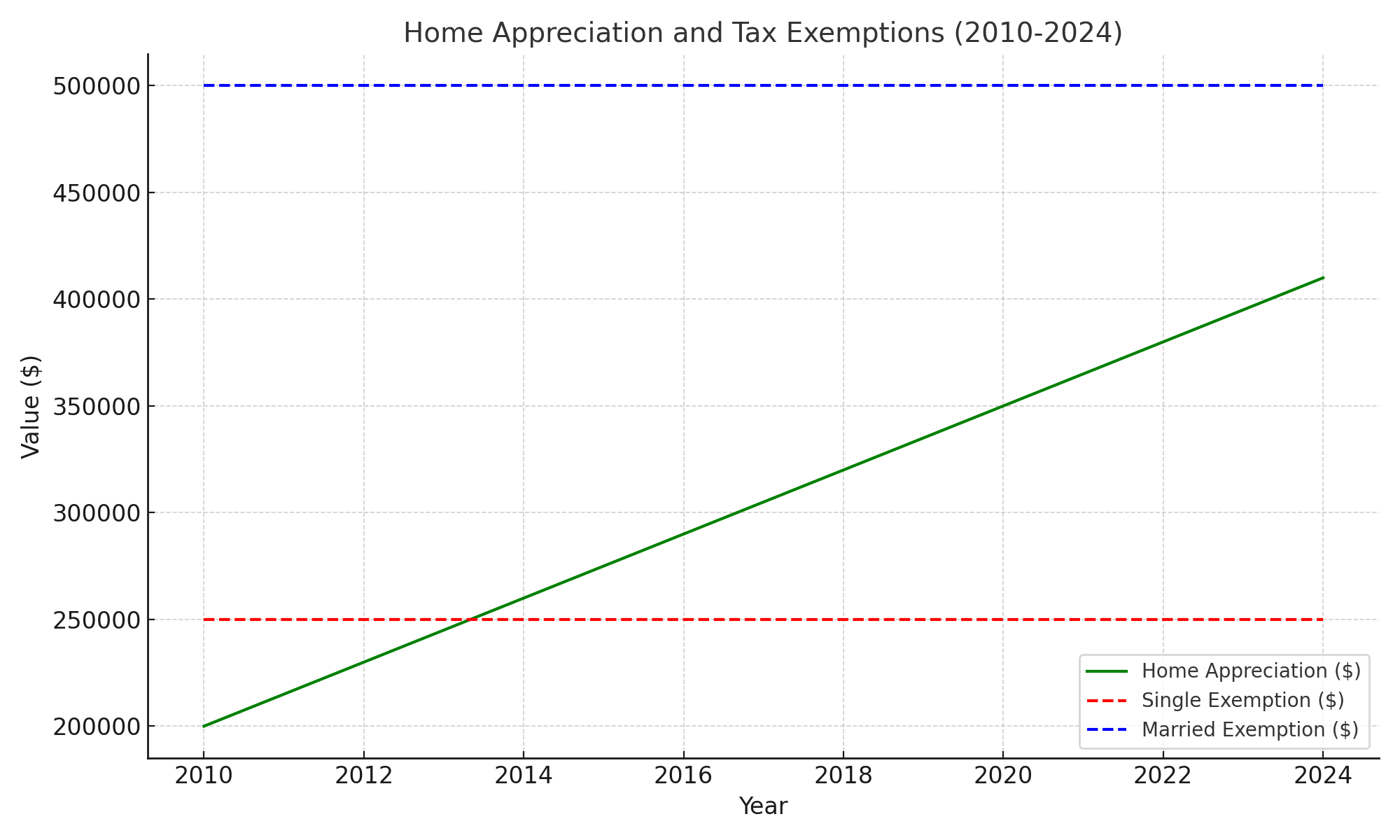

Capital gains taxes on home sales are another significant worry. Sellers often underestimate how much they’ll owe or whether they qualify for exemptions.

Understanding the Rules:

- Exemption Thresholds: Single filers can exclude up to $250,000, and married couples up to $500,000, of the gain if they meet the ownership and use tests.

- 2024 Updates: Inflation adjustments increased the maximum gain thresholds slightly, but only for long-term homeowners.

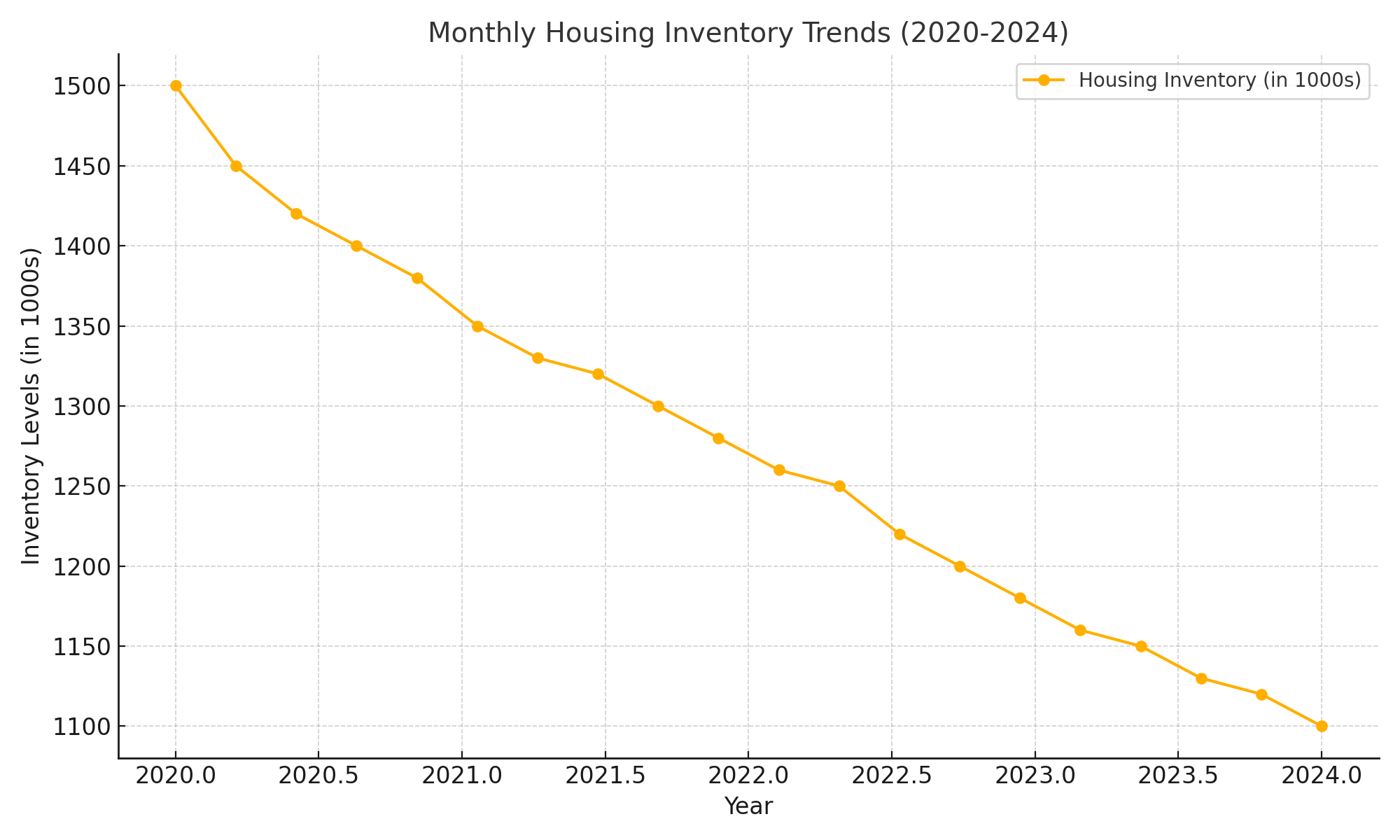

6. Leverage Low Inventory to Negotiate Better Deals

The current housing market’s low inventory works in favor of sellers. With fewer homes available, buyers are often willing to pay a premium or accommodate seller preferences, such as extended closing times. Having cash on hand not only strengthens your negotiating position but also allows you to compete effectively for your next property, giving you the upper hand in multiple-offer situations.

According to a 2024 report by the National Association of Realtors (NAR), housing inventory in the U.S. was down by 18% year-over-year, exacerbating competition among buyers. This trend impacts sellers who simultaneously need to buy, often leaving them in a precarious position.

7. Preparing Your Home for Maximum Proceeds

To achieve the best possible sale price, preparing your home is essential. This includes staging, minor repairs, and deep cleaning to enhance its appeal. Data consistently shows that well-presented homes sell faster and at higher prices. For instance, staged homes typically sell for 5-10% more than their non-staged counterparts, providing a significant return on investment.

To ensure you get the highest possible price for your home, consider the following steps:

- Enhance Curb Appeal: First impressions matter. Invest in landscaping, paint, and minor repairs to make your home inviting to potential buyers.

- Stage Your Home: Professional staging can help buyers envision themselves in your space. Decluttering and depersonalizing your home can make it more appealing.

- Highlight Key Features: Focus on the unique features of your home that stand out, whether it’s energy efficiency, smart home technology, or expansive living spaces.

- Price Strategically: Work with a real estate professional to set a competitive price. An accurate valuation will attract serious buyers and foster bidding wars, which can drive up your sale price.

Categories

Recent Posts